Towerpoint Wealth is a fully independent wealth management firm based in Sacramento. Our fiduciary advisors are working to helping you remove the hassle of properly coordinating all of your financial affairs so you can live a happier life and enjoy retirement.

This statistic makes us particularly happy, honored, and proud to be celebrating our fifth anniversary as a boutique, fully-independent wealth management firm. After 18 years managing the constraints of being employees for a major Wall Street firm, we launched Towerpoint Wealth on May 26, 2017. Can you believe five years have passed?

And as we eclipse this milestone, we continue to be resolute in focusing on and advancing our mission:

Helping you remove the hassle of properly coordinating all your financial affairs, so you can live a happier life and enjoy retirement

We are very humbled by this milestone, and offer a sincere thank you to our clients, partners, colleagues, family, and friends for your confidence, trust, and support. You represent our lifeblood, as we certainly would not be where we are today as a fully-independent firm, nor would we have grown, matured, and advanced as much as we have without all of you entrusting us to help you navigate the very unsettled world we live in. And while much work remains to be done (both for us as a fully independent firm and also for us, in our joint effort with you within each of our partnerships), we are eager and excited for what the next five years has in store!

The phrase “fully independent firm” holds as much significance for you as it does for us. What few people know about working with a fully independent wealth management firm is the much stronger professional and personal responsibility we have to you – specifically, a legal fiduciary obligation. As your fiduciary financial advisor, we are legally responsible to put your personal and financial interests before our own and always act in your best interests, 100% of the time. This is the definition of fiduciary. Are all financial advisors fiduciaries? Absolutely not. This is an extremely important distinction, and was not an obligation we were bound to while we were employed by a major Wall Street firm. It is one that we were eager and have been happy to embrace, every day, for going on six years.

This all begs a very important question: What does having a fiduciary financial advisor mean, and why should you care?

Full independence means fiduciary advisors with a legal duty to you

Putting aside the very important fact that a fiduciary relationship is generally viewed as the highest standard of client care available under law, below are three of the most common considerations when deciding whether to partner with a fiduciary financial advisor:

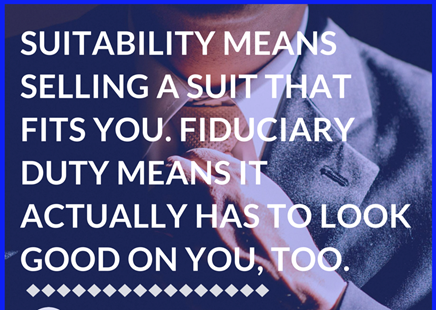

1. The suitability standard (doing what is suitable for a client) is MUCH different than the fiduciary standard (doing what is in a client’s best interests always).

Investment brokers who work for broker-dealers (such as Merrill Lynch, UBS, Morgan Stanley, and Wells Fargo), and investment advisors who work for fully independent registered investment advisory (RIA) firms like Towerpoint Wealth, both offer financial and investment planning, counsel, and advice. However, they are not governed by the same standards

• Investment advisors work directly for clients, and must place clients’ interests before their own, according to the Investment Advisers Act of 1940 – this is known as the fiduciary standard.

• Investment brokers work for, and serve, their broker-dealers, and must only ensure that their recommendations are suitable for their clients – this is known as the fiduciary or suitability standard.

It is accepted as fact that the fiduciary standard is better and more comprehensive than the suitability standard, that a financial advisor with a fiduciary responsibility is rising to a much higher level of duty and care, and deals with no competing interests, a higher quality of investments, full disclosure, fee transparency, and client-centered advice 100% of the time.

Peter Lazaroff from Forbes has excellently summarized this important differentiation in his April 6, 2016 article. We believe this meme does too.

2. If you do not have a fiduciary financial advisor, you have fewer legal options in the event you discover your interests haven’t been fully served.

A breach of fiduciary duty occurs when a financial advisors fails to act responsibly or in the complete best interests of a client. Usually, the actions are alleged to have benefitted the fiduciary's interests or the interests of a third party instead of the interests of the client.

By law, a plaintiff must show that a fiduciary duty existed. If a breach of duty case proceeds to the courts, major consequences can result. A successful breach-of-fiduciary-duty lawsuit can result in monetary penalties for direct damages, indirect damages, and legal costs. A court ruling can also lead to discrediting, the loss of license, or removal from service.

You do not have this legal recourse if you are not working with a fiduciary financial advisor (see Point 3 below).

3. If you have a relationship / partnership with an advisor who works for a major Wall Street firm, you do not have a fiduciary financial advisor.

We should know – we worked for a major Wall Street firm for 18 years! Please do not misconstrue our comment, as we firmly believe that most advisors who work for one of the four largest “wirehouses” (Morgan Stanley, Merrill Lynch, UBS, and Wells Fargo) do good work. However, it is impossible to act in a client’s best interests 100% of the time when operating within the constraints of the employee-employer relationship. This advisor inherently has a primary obligation first to their employer.

Don’t believe us? Feel free to confirm for yourself: Ask your current wirehouse advisor if he/she would be willing to attest to and sign this simple Code of Ethics document stating that they are a legal fiduciary to you, and see what they have to say!

It is important to understand that the only requirement to be called a financial advisor is that you dispense financial advice. It is also important to understand that no rule, label, or regulation will completely stop those who have intent to disregard doing what is right (Bernie Madoff was technically a “fiduciary” for the last two years of his career).

Despite this sad fact, engaging a fiduciary financial advisor tilts the odds in your favor; you are much more likely to wind up with a professional who takes seriously their legal fiduciary obligation to you when they are fully independent.

For the past six years, we have embraced the role of fiduciary financial advisor in our clients’ lives. It’s been a responsibility we fully honor, take seriously, and recognize is a tremendous privilege.

Interested in learning more about how we help our clients build and protect their net worth?

What is Happening at TPW?

The TPW family shared a fun day of teambuilding a few weeks ago, soaking in a sunny day of Sacramento River Cats baseball at Sutter Health Park.

Hey Joe and Steve, slow down and calm down, those hot dogs aren’t going anywhere…!

Did somebody say Italian??!!

Apparently fresh risotto makes for a happy Lori and a happy Michelle, as the ladies of Towerpoint Wealth enjoyed a bite to eat together last week at Il Fornaio on Capitol Mall!

What else is happening with the Towerpoint Wealth family?

TPW Taxes 2022

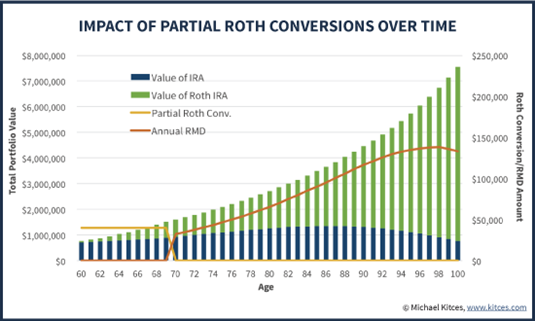

How do you find opportunity during a market pullback, and make lemons out of lemonade when account values are temporarily depressed?

As investors emerge from a tumultuous market over the first five months of 2022, the current volatility may pose an opportunity for IRA account holders. Considering a partial conversion to a tax-free Roth IRA may be advantageous right now.

This Kiplinger article outlines two reasons to consider a Roth conversion now, plus a few traps to avoid.

Curious if you might benefit from a partial Roth IRA conversion in 2022?

TPW News You Can Use

Useful and interesting content we read the past two weeks:

1. Top-Paid LA Lifeguards Earned Up to $510,000 in 2021 – OpenTheBooks Substack – 5.31.2022

Who knew that LA lifeguards – who work in the sun, ocean surf, and golden sands of California – could reap such unbelievable financial rewards? It’s time we put Baywatch on pay watch!

2. Why Most Americans Are Losing the Battle of Getting into Pre-COVID Shape – NY Post – 6.1.2022

Squeezing back into a pair of jeans bought before March 2020 is a challenge for lots of Americans — and a new study found that injury may be to blame. The study of 2,000 adults, by OnePoll in partnership with CURAD, found that seven out of 10 respondents said they stopped working out during the thick of the COVID-19 pandemic.

3. From Ukraine’s Front Lines, Bravery and Wreckage – New York Times – 6.1.2022

Amid the roar of artillery and bone-rattling explosions, New York Times photographers have borne graphic witness to the fight to survive.

These are their stories and images.

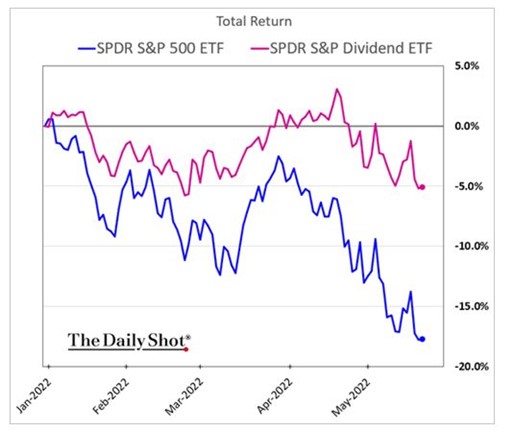

Chart / Infographic of the Week

As we have repeatedly stressed, dividends matter!

A compelling chart below, supporting the philosophy that owning and investing in dividend-paying equities (the purple line) is rarely a bad idea, especially during times of extreme market volatility like we have experienced in 2022...

TPW Educational Video : The Importance of Estate Planning

Why is it ESSENTIAL to have an up-to-date estate plan?

Click the thumbnail below to watch an excellent video that focuses on the benefits of estate planning to avoid probate, and to ensure that your assets are distributed according to your wishes and in a timely fashion.

What do you want for your loved ones when you are gone? A protracted, expensive public legal process (known as probate), or a tax-efficient and streamlined disposition of the assets in your estate?

Trending Today

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- A Warriors dynasty reborn or a Celtics 18th banner? Experts’ NBA Finals picks

- Trump threatens to sue Pulitzer Prize Board if NY Times, Washington Post prizes are not rescinded

- To combat inflation, the Federal Reserve starts experiment of letting its $8.9 trillion balance sheet and portfolio shrink

- Average US gas prices rise another five cents, to a record high of $4.67/gallon

- The Fed is losing control of the inflation narrative

- How the world is paying for Vladimir Putin’s war in Ukraine

- In worsening drought, SoCal water restrictions take effect

Quote of the Week

Below is found one of our favorite quotes from investing legend Shelby Davis. His philosophy can be difficult to grasp when prices (and account values) are temporarily declining; however, we (and Shelby Davis) believe that you will make more money in a down market by being disciplined in doing two things:

1. Not giving into fear by selling low, and

2. Being courageous in buying and investing more when prices are low

These are simple but certainly not easy concepts to understand and practice, yet we are confident that doing so will pay the greatest ultimate rewards over time.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

– Joseph, Jonathan, Steve, Lori, Nathan, and Michelle

Are you searching for a Sacramento Wealth Advisor near me? We serve clients primarily in the Northern California region. Glad you’re here! Please contact us with any questions you have about our services.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!